are hoa fees tax deductible in california

There are many costs with homeownership that are tax-deductible such as your mortgage interest. As a general guideline no.

Are Hoa Fees Tax Deductible Experian

Are HOA Fees Tax Deductible.

. You may be wondering whether. However there are special cases such as when the home is rented out or used only part-time. However there are special cases as you now know.

But there are some exceptions. If you have purchased a home or condo you are likely paying a monthly fee to cover repairs and maintenance on the outside of your home or in common areas. HOA fees on personal residence - not deductible.

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. Exemption for California HOA Tax Returns. Are HOA fees tax deductible.

Specifically under Revenue and Taxation code section 23701t they may qualify as tax exempt. If you pay less than 10000 of california tax your property tax deduction will be the difference between 10000 and your state income tax liability. Before claiming your HOA fees you will have to determine how much space your home office takes up in your house.

From maintenance and repair to landscaping and enrichment of common areas. The IRS considers HOA fees as a rental expense which means you can write. HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas.

In general homeowners association HOA fees arent deductible on your federal tax return. In order to meet tax exempt status in California. Where do you deduct HOA fees for rental property.

Are hoa fees tax deductible in ca. Unfortunately homeowners association HOA fees paid on your personal residence are not deductible. Filing your taxes can be financially stressful.

HOA feescan cover a range of services that keep property values high. If your property is used for rental purposes the IRS considers. As a general rule most HOA fees are not tax-deductible.

A homeowners association runs a community by imposing certain rules preserving its aesthetics and maintaining various aspects of the neighborhood. As a general rule no fees are not tax-deductible. Deduct as a common business expense for your rental.

If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities. So are HOA fees tax-deductible. However if you have an office in your home that you use in connection with a trade or business then you may be able to deduct a.

Yes HOA fees are deductible for home offices. Are homeowners association fees tax deductible. Once you figure out the percentage youll use that number to deduct your HOA fees.

Tax obligations can be complicated when owning a house or condo that belongs to a homeowner organization. Specifically under Revenue and Taxation code section 23701t they may. If you purchase property as your primary residence.

There may be exceptions however if you rent the home or have a home office. As a homeowner it is part of your. Are hoa fees tax deductible in california.

HOA fees are typically not 100 percent deductible but you may still be able to claim some portion of them as a writeoff. If your property is used for rental purposes the IRS considers HOA fees tax deductible as a rental expense. Are hoa fees paid on a rental property tax deductible.

What Carl is saying is that with high income if the rental property loses money that loss will not be deductible in 2019 so there. Say Thanks by clicking the thumb icon in a. Hoa fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas.

The requirement to file Form 199 or FTB 199N is independent of. Generally HOA dues are not tax deductible if you use your property as a home year-round. Your HOA is a private entity managing th.

Year-round residency in your property means HOA fees are not deductible. If your homeowners association is granted tax-exempt status it may be required to file Form 199 FTB 199N andor Form 100.

Are Homeowners Association Fees Tax Deductible

Inman Here S A List Of Tax Deductions For Re Agents

2021 Major Tax Breaks For Taxpayers Over Age 65

Are Hoa Fees Tax Deductible Here S What You Need To Know

San Francisco Property Taxes Kevin Jonathan Top San Francisco Real Estate Kevin K Ho Esq Jonathan Mcnarry Vanguard Properties 415 297 7462 415 215 4393

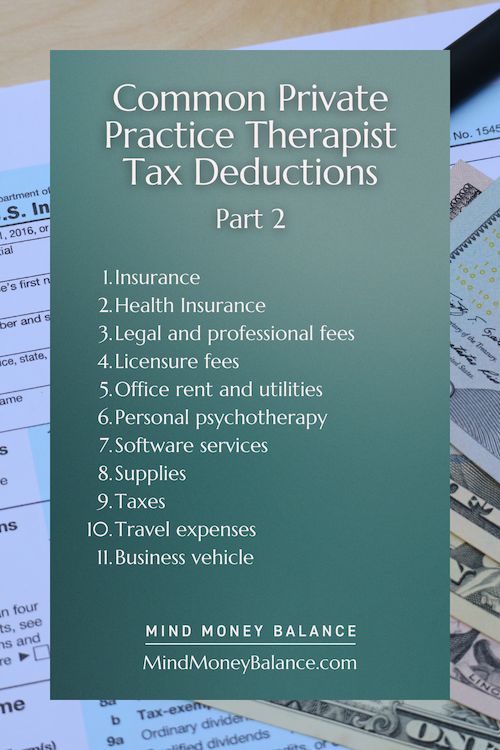

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Are Hoa Fees Tax Deductible Complete Guide Hvac Buzz

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Hoa Fees Tax Deductible Clark Simson Miller

How Electric Vehicle Tax Credits Work

Can I Write Off Hoa Fees On My Taxes

Are Hoa Fees Tax Deductible Clark Simson Miller

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Can I Write Off Hoa Fees On My Taxes

Can I Write Off Hoa Fees On My Taxes

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Are Hoa Fees Tax Deductible Here S What You Need To Know

Are Hoa Fees Tax Deductible Here S What You Need To Know

Hoa Tax Return The Complete Guide In A Few Easy Steps Template